Every patent in your portfolio costs you money, time, and focus. Some protect your core tech. Some quietly drain your budget. If you are building a serious startup, you cannot afford dead weight. A sunset review is a simple idea: once a year, you look at every patent you own and decide what lives and what goes. Done right, this one habit can free up cash, sharpen your strategy, and make your IP stronger—not bigger. Let’s walk through a clear 12-month plan to trim your portfolio without risking the assets that truly matter.

Why Most Patent Portfolios Get Bloated (And Why It Hurts Growth)

Most founders do not wake up one day and decide to build a messy patent portfolio. It happens slowly. One filing turns into five. Five turn into twenty. Each felt important at the time.

Each had a story. Each had a reason. But over the years, the portfolio grows faster than the company strategy.

What once felt like protection can quietly become a burden. If you do not step back and look at it with fresh eyes, you end up paying for ideas that no longer move your business forward.

The “File Everything” Mindset

In the early days, filing feels like winning. You close a round, and your investors ask about IP. You ship a new feature, and someone says, “Let’s patent that.”

You build a new model, and your lawyer suggests locking it down. This creates momentum. Patents feel like proof of progress.

The problem is not filing patents. The problem is filing without a filter.

When you file on everything, you are treating every experiment like a long-term bet. But startups pivot. Roadmaps change. Markets shift. What was core last year may now be a side project.

Yet the patent tied to it still demands payment every year. Fees do not care about pivots.

A strong portfolio is not about volume. It is about focus. If your patent strategy does not match your current product strategy, you are leaking money.

One simple habit can help here. Before you file anything new, ask one hard question: if this were the only patent we owned, would it still matter in three years? If the answer is unclear, slow down. That pause alone prevents future bloat.

If you want a cleaner way to connect filings to real product value, take a look at how PowerPatent works. It is built to help founders turn real innovation into defensible protection without filing blindly.

You can see the process here: https://powerpatent.com/how-it-works

Defensive Panic Filing

Sometimes portfolios grow because of fear. A competitor raises a big round. A large company enters your space. Your team feels pressure. The response is often to file fast and file wide.

This panic creates weak patents. They are rushed. The claims are too narrow or too vague. The real goal was emotional comfort, not long-term strategy.

Fear-based filing rarely aligns with revenue. It aligns with anxiety.

Over time, these patents sit in your portfolio. They do not block competitors in a meaningful way. They do not strengthen your moat. But they do increase maintenance fees.

They increase management overhead. They make your IP map harder to understand.

A better move is to map competitor risk before you file. Look at what they are actually shipping, not what they might ship.

Tie your claims to the parts of your system that create switching costs or performance gaps. File where you have true leverage.

If you cannot explain in simple words how a patent hurts a competitor or protects your revenue, it may not deserve long-term life in your portfolio.

Investor Signaling Gone Too Far

Many founders build patent portfolios for optics. Investors like to see filings. A pitch deck slide with “15 patents filed” sounds strong. The issue comes when that slide becomes the goal.

Signaling is not strategy.

When you file to impress rather than to protect, you disconnect IP from business value. The portfolio grows in size but shrinks in impact.

The real signal investors care about is defensibility tied to traction. They want to know that your core technology is hard to copy and hard to work around. Ten weak patents do not create that story.

Two well-crafted patents tied to your main engine might.

During a sunset review, look at each patent and ask: if an investor asked how this supports our moat, could I answer clearly? If you struggle to explain, that patent may be a candidate for trimming.

Strategically, it helps to align each patent family with a revenue stream. If a product line generates 40 percent of revenue, it should likely anchor a large part of your IP.

If another product was sunset internally but still has active patents, that is misalignment. Clean that up.

If you want guidance on aligning filings with what truly drives your startup, PowerPatent combines software tools with real attorney oversight so your patents match your actual business.

You can explore that model here: https://powerpatent.com/how-it-works

The “We Already Paid for It” Trap

One of the biggest reasons portfolios stay bloated is simple psychology. You already spent money to file. It feels wrong to let that investment go. So you keep paying maintenance fees.

This is sunk cost thinking.

The only question that matters today is whether keeping the patent creates more value than it costs. Past fees do not matter. They are gone.

A tactical way to break this bias is to treat each patent like a new purchase decision. Imagine someone offers to sell you this exact patent today for the next three years of maintenance fees.

Would you buy it? If not, why are you keeping it?

This thought experiment removes emotion. It forces clarity.

You can also run a simple financial test. Add up expected maintenance fees over the next five years. Then ask what that cash could do inside the company.

Could it fund a key hire? Extend runway? Support a product launch? If the alternative use of funds creates more upside than the patent, the answer becomes clear.

Strong founders protect what matters. They do not protect everything.

No Clear Owner of the Portfolio

Many companies do not have a single person responsible for IP strategy. The CTO files ideas. The CEO signs off on bills. Outside counsel sends reminders. No one steps back and sees the whole picture.

When ownership is unclear, growth is automatic. No one wants to be the person who kills a patent. So nothing gets cut.

A portfolio needs a steward. Not someone who just approves invoices, but someone who ties patents to company goals.

That steward should review product roadmaps, revenue breakdowns, and competitive risks at least once a year.

They should know which patents cover core code, which protect hardware designs, and which relate to features no longer shipped.

During a sunset review, assign one leader to gather all patent families, upcoming fees, and related products into a single view. Clarity alone often reveals excess.

This is where modern tools matter. If your IP lives in scattered email threads and PDF folders, it is hard to see patterns.

With a structured system like PowerPatent, you can connect filings directly to your technology and track them in one place, with attorney input built in. That visibility makes trimming far easier.

Learn more here: https://powerpatent.com/how-it-works

Product Drift and Patent Drift

Startups evolve fast. Your first version may have focused on one technical approach. Two years later, you may use a different architecture or model. Yet your early patents remain tied to the old design.

This creates drift.

Patent drift happens when your IP no longer reflects your current system. It is like carrying a map of a city you no longer live in.

To avoid this, tie every patent to a current system diagram. If you cannot point to the exact part of your live product that uses the claimed invention, that patent may not deserve future investment.

This does not mean every old patent is useless. Some can still block competitors even if you no longer use the method internally. But that must be a conscious decision, not an accident.

A strategic move is to review patents right after major product shifts. If you pivot your core engine, that is a natural moment to ask which old filings still serve a purpose.

Do not wait five years to realize your IP protects a version of your product that no longer exists.

Growth Without Pruning Slows You Down

A bloated portfolio does more than cost money. It slows decisions.

When you consider partnerships, acquisitions, or licensing deals, a messy portfolio makes diligence painful. Buyers and partners will ask which patents matter. If you cannot answer quickly, confidence drops.

A tight portfolio tells a clean story. It shows discipline. It shows that you understand your own technology.

From a strategic point of view, trimming is not about shrinking. It is about sharpening. A smaller, focused set of patents that clearly protect your core engine is often stronger than a large collection of random filings.

Think of your portfolio like your product. You would not keep features that no one uses. You would remove them to improve performance. Your IP deserves the same treatment.

Sunset reviews are not a sign of weakness. They are a sign of maturity.

When done well, they free up cash, increase clarity, and make your protection more credible. In the next section, we will walk through a clear 12-month plan to run a sunset review without putting your crown jewels at risk.

The 12-Month Sunset Review Framework: Step-by-Step

If you only look at your patents when a bill shows up, you are already behind. A sunset review is not a one-day task. It is a rhythm. It is a yearly cycle that keeps your portfolio tight, aligned, and useful.

When you treat it as a structured 12-month process instead of a last-minute reaction, you make smarter decisions with less stress.

This framework is not complex. It is disciplined. Each phase builds on the last. By the end of the year, you will know exactly which patents deserve long-term life and which ones should be allowed to fade away.

Month 1: Reset the Goal

Before you review a single patent, you need to reset the purpose of your portfolio.

Most teams start by asking, “Which patents should we keep?” That is the wrong starting point. The better question is, “What are we protecting now?”

Your company today is not the same company it was when many of your patents were filed. Revenue streams change. Your main product evolves. Your real risks shift.

At the start of the cycle, gather your leadership team and define three simple things in plain language. What product drives the most revenue? What technical advantage makes you hard to copy?

What future roadmap items could change your market position?

Write these down in clear terms. No legal talk. No abstract words. Just honest answers.

This becomes your filter for the rest of the year.

If your patents do not clearly connect to these priorities, they move closer to the sunset line.

If you want help connecting product strategy to patent strategy in a clean way, this is exactly what PowerPatent was built to support. It helps you turn real technical advantage into structured protection with real attorney oversight. You can see how it works here: https://powerpatent.com/how-it-works

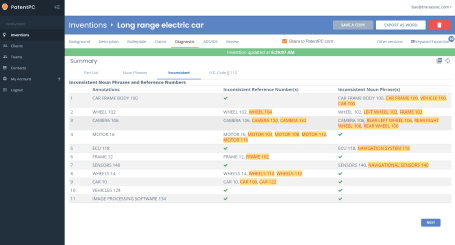

Month 2: Build a Clear Portfolio Map

Most founders cannot see their entire portfolio on one screen. That is a problem.

In the second month, your goal is simple. Build a living map of your patents. Each patent family should be tied to a product, feature, or system component. If you cannot tie it to something real, mark it clearly.

This map should also show upcoming maintenance fees for the next five years. When you see future costs next to each patent, decisions become grounded in reality.

The act of mapping alone often reveals waste. You may find patents covering features you stopped shipping. You may see multiple filings covering very similar concepts with slight wording changes.

You may notice that one business unit has twice the patent coverage of another, even though it generates less revenue.

Clarity reduces emotional attachment. It replaces vague pride with concrete data.

Modern tools make this easier. When patents are connected to technical documentation and code, not just stored as PDFs, review becomes practical instead of abstract.

PowerPatent was designed to connect invention details to filings in a structured way so founders can actually see what they own and why. Learn more here: https://powerpatent.com/how-it-works

Month 3: Score Each Patent by Business Impact

Now that you have visibility, you need a way to measure value without turning the process into a spreadsheet nightmare.

For each patent, ask a simple set of business-focused questions. Does this patent protect a feature customers pay for?

Would a competitor gain meaningful ground if they copied what this patent covers? Does it block a core technical shortcut in your space?

Do not rate patents by how clever they sound. Rate them by impact on revenue, market position, or leverage in negotiation.

Some patents protect infrastructure that users never see but is critical to performance. Those often matter deeply. Others protect edge cases that rarely surface in customer conversations. Those may be less important.

Have both technical leaders and business leaders weigh in. When engineering and revenue teams agree that a patent protects something vital, it is likely a keeper. When both struggle to explain its role, that is a warning sign.

This month is about honest scoring. Not legal analysis. Business impact.

Month 4: Identify Drift and Redundancy

By now, patterns will start to show.

You may notice clusters of patents around older technical approaches. You may see multiple patents that cover slight variations of the same idea. You may find that early filings were broad in theory but narrow in practice.

This is where drift becomes clear.

Go back to your current system architecture. Compare it to the claims of your patents. Where is the match strong? Where is it weak? Where does your live product now rely on methods that are not covered at all?

Drift can cut both ways. Some patents no longer reflect your system and may not justify ongoing fees. Others may reveal gaps where you need stronger protection.

The goal here is not to cut immediately. It is to understand alignment.

If your current core engine is under-protected while old side projects are heavily covered, your portfolio is out of balance. That imbalance is more dangerous than simply having too many patents.

Month 5: Model the Financial Trade-Off

Now shift to numbers.

Add up the projected maintenance costs for each patent family over the next three to five years. Do not estimate loosely. Use actual fee schedules. Include foreign jurisdictions where relevant.

Then compare that cost to the strategic impact score you assigned earlier.

If a low-impact patent will cost a meaningful amount to maintain, the math becomes clearer. On the other hand, a high-impact patent with moderate fees may be an obvious investment.

This is also the right time to think about runway. If cash is tight, trimming weaker patents can extend survival without harming your core advantage.

Treat each decision like capital allocation. You are choosing between maintaining protection or investing that same money elsewhere in the company.

Strong founders allocate capital with intention. Your IP budget should follow the same logic as your hiring and product budgets.

Month 6: Consult with Counsel Strategically

Mid-year is the right time to bring in legal perspective. Not to drive the decision, but to stress-test it.

Share your business impact scores and financial models with your patent attorney. Ask them to evaluate enforcement strength, claim breadth, and potential licensing value.

Some patents that look weak from a product view may still offer strategic blocking power. Others that look broad may be easier to design around than you think.

The key is alignment. Your attorney should understand your product roadmap and market reality, not just the claims on paper.

This is where having a system that blends software clarity with real attorney oversight matters.

PowerPatent was built around this exact model. It gives founders tools to organize their inventions while ensuring real attorneys guide the strategy. If you want that blend of speed and legal strength, explore it here: https://powerpatent.com/how-it-works

Month 7: Flag Candidates for Sunset

By this point, you are ready to mark candidates for possible expiration.

Do not rush to abandon them yet. Instead, create a watch list. These are patents with low business impact, weak alignment with your roadmap, or high cost relative to value.

Label them clearly and set decision deadlines based on upcoming fee dates.

This approach avoids panic. You are not killing patents emotionally. You are managing them deliberately.

Month 8: Reassess Against Roadmap Updates

Roadmaps change mid-year. New partnerships form. Market conditions shift.

Before final decisions are made, revisit your watch list in light of any changes. A patent that seemed minor six months ago may now support a new feature. Or a feature may have been removed entirely.

This step ensures that sunset decisions reflect current reality, not outdated assumptions.

Month 9: Final Decision Window

Now make the call.

For each flagged patent, decide whether to maintain, sell, license, or allow it to expire. Document the reasoning in plain language. Future leadership will appreciate that clarity.

When you let a patent go, treat it as a strategic choice, not a failure. You are reallocating resources toward stronger protection.

Month 10: Strengthen What Remains

After trimming, turn attention to reinforcement.

For high-impact patents, consider whether continuation filings or broader claims are needed. If gaps were identified earlier, this is the time to file strategically.

Sunsetting weak assets should create space and budget to deepen protection where it matters most.

Month 11: Communicate the Strategy

Investors, board members, and internal teams should understand that your portfolio is curated, not accidental.

Explain how the sunset review sharpened focus and improved capital efficiency. Show how the remaining patents align tightly with core technology.

This builds confidence. It signals discipline.

Month 12: Lock in the Habit

The final month is about institutional memory.

Schedule next year’s reset. Document the process. Assign clear ownership. Make sunset reviews a standard part of your company rhythm.

When this becomes routine, portfolio bloat loses power. You stop reacting and start leading.

A 12-month cycle may sound long, but it creates calm. You avoid last-minute fee shocks. You avoid emotional attachment. You turn IP from a cost center into a strategic asset.

In the next section, we will go deeper into how to cut safely without cutting what truly protects your advantage.

How to Cut Safely Without Cutting What Matters

Trimming a patent portfolio sounds simple until you face the real fear behind it.

What if we let go of something important?

What if a competitor uses it later?

What if we regret the decision?

These fears are normal. They are also the reason many portfolios stay bloated for years. The key is not to avoid cutting. The key is to cut with structure, clarity, and protection around your core advantage.

When done right, trimming does not weaken your position. It strengthens it.

Start With Your Crown Jewels

Every company has a small number of technical assets that truly matter. Not ten. Not twenty. Usually two to five core innovations drive most of the value.

These are the systems that make your product faster, cheaper, more accurate, or easier to use than anything else in the market.

Before you sunset anything, clearly define these crown jewels in plain words. What exact mechanism gives you leverage? Is it a training method? A data pipeline design?

A hardware configuration? A protocol that reduces latency? A model architecture?

Once you define this clearly, review whether your strongest patents actually cover those mechanisms.

You may be surprised.

Sometimes the patents that cost the most to maintain are not the ones protecting your most valuable engine. If that is the case, the real risk is not trimming too much. The real risk is protecting the wrong things.

If you are unsure whether your core technology is properly captured, this is where a structured approach matters.

PowerPatent helps founders turn real code, models, and system diagrams into filings that reflect the actual product, not a vague description.

And every filing is reviewed by real patent attorneys. You can see how that works here: https://powerpatent.com/how-it-works

Separate Emotional Value From Strategic Value

Founders remember the story behind a patent. The late nights. The first breakthrough. The first investor pitch.

But stories do not pay maintenance fees.

When reviewing patents for possible sunset, strip away personal attachment. Ask one simple question: does this asset protect our current or future revenue?

If the answer is unclear, go deeper. Could a competitor meaningfully use this idea today to take market share? If not, holding it may be more about memory than strategy.

This does not mean your early inventions were not important. They may have been critical stepping stones. But stepping stones are not always long-term assets.

The discipline to separate emotion from impact is what keeps your portfolio lean and powerful.

Think in Terms of Competitive Scenarios

A safe cut requires scenario thinking.

Imagine your strongest competitor launches a similar product next year. Which patents would you rely on to slow them down? Which would you never mention because they are too narrow or too outdated?

If a patent would not even come up in that conversation, it may not justify ongoing cost.

Now flip the scenario. Imagine you are raising a large round or exploring acquisition. Which patents would you highlight as proof of defensibility? Which would you quietly hope no one asks about?

This exercise forces clarity. It surfaces the patents that truly carry weight.

A strong portfolio should support both enforcement and negotiation. If an asset supports neither, it deserves scrutiny.

Protect the Core, Let Go of the Edges

Many bloated portfolios are filled with edge-case inventions. Small features. Minor improvements. Alternative flows that never became mainstream.

These filings often felt smart at the time. But over years, they pile up and distract from the core engine.

When trimming, focus on preserving depth around your central system rather than breadth around minor features.

Depth means layered protection. It means covering the core method, key variations, and practical implementations. It means protecting not just what you built, but how it works under the hood.

Breadth across unrelated features rarely creates the same strength.

If budget allows only a limited number of patents to survive, concentrate that budget where your long-term moat lives.

Use Expiration Timing to Your Advantage

Not all cuts have to be dramatic.

Many patents face maintenance fees at predictable intervals. Instead of reacting at the last minute, plan your sunset decisions months ahead.

If a patent is on your watch list and a major fee is due in six months, use that window to observe market signals. Are competitors moving in that direction? Is your roadmap shifting back toward that feature?

This buffer period reduces regret. It allows you to make decisions with fresh data rather than pressure.

It also gives you time to explore alternatives such as licensing or selling if the patent has niche value outside your main focus.

Strategic trimming is rarely about instant abandonment. It is about planned transitions.

Watch for Hidden Dependencies

Before letting a patent expire, confirm it does not quietly support a broader family.

Some patents share priority dates or are linked through continuation filings. Letting one expire could affect the strength or scope of related assets.

Work closely with counsel to understand these relationships.

This is another reason why scattered documentation is risky. If your portfolio lives in disconnected emails and folders, you may miss structural ties.

A structured platform that maps patent families clearly makes this review safer. When your filings are organized and connected to your underlying inventions, it becomes easier to see the impact of each decision.

PowerPatent was designed with this visibility in mind, blending software clarity with attorney guidance. Learn more here: https://powerpatent.com/how-it-works

Consider Strategic Abandonment as a Signal of Strength

Many founders worry that trimming looks weak. In reality, disciplined pruning signals maturity.

Investors understand capital efficiency. They respect founders who allocate resources intentionally.

When you explain that you sunset low-impact patents to double down on your core technology, you demonstrate control. You show that IP is a tool, not a vanity metric.

A clean portfolio tells a simple story. It says: we know what matters, and we protect it deeply.

That clarity often creates more confidence than a long list of unrelated filings.

Build a Replacement Strategy Before You Cut

Safe trimming also means thinking forward.

If you identify a patent that no longer fits but recognize a new innovation emerging in your current roadmap, align the sunset with fresh filings.

You are not shrinking protection. You are rotating it.

For example, if an old architecture patent no longer reflects your live system, but your new system includes a novel optimization layer, consider filing around that new layer before letting the old asset go.

This keeps protection aligned with reality.

The goal is not to maintain a constant number of patents. The goal is to maintain constant relevance.

Make Sunset Reviews Part of Company Culture

The safest cuts happen in companies where review is normal.

If sunset decisions only occur during financial stress, they feel reactive and risky. When they are part of an annual rhythm, they feel strategic.

Talk about portfolio focus in leadership meetings. Tie patent discussions to product strategy. Make it clear that every asset must earn its place each year.

Over time, this culture reduces fear. Teams understand that patents are tools to serve the mission, not trophies to collect.

When you combine disciplined review with smart filing from the start, trimming becomes easier. That is why using a modern platform that connects invention capture, drafting, and attorney oversight can prevent bloat before it begins.

PowerPatent was built to help founders file what matters and skip what does not, without slowing down innovation. If you want to see a cleaner way to build and manage your portfolio, visit https://powerpatent.com/how-it-works

Sunset reviews are not about cutting for the sake of cutting. They are about aligning protection with purpose. When your portfolio reflects your real competitive edge, every dollar you spend on it works harder.

That is how you turn IP from a silent cost into a sharp strategic weapon.

Wrapping It Up

A patent portfolio should feel like a shield, not a storage unit. If it feels heavy, confusing, or expensive without clear return, something is off. And the fix is not to ignore it. The fix is to review it with discipline. A sunset review is not about shrinking for the sake of shrinking. It is about alignment. It is about making sure every active patent protects something real, something current, something tied to revenue or leverage. When you run a structured 12-month review cycle, you move from reactive fee payments to intentional strategy. You stop asking, “Can we afford to keep this?” You start asking, “Does this help us win?”