When buyers look at your startup, they are not just buying code. They are buying control. They are buying leverage. They are buying protection. And if your patent story is messy, noisy, or unclear, your valuation drops fast. M&A readiness is not about having the most patents. It is about having the right patents, clearly positioned, cleanly structured, and aligned with what makes your company valuable. In this guide, we will walk through exactly how to prune noise, highlight strategic patents, and turn your IP into a deal-making asset instead of a due diligence headache.

What Buyers Really Look for in Your Patent Portfolio

When a company looks at buying your startup, they are not trying to be impressed. They are trying to feel safe. They want to know that what they are buying will not fall apart after the deal closes.

Your patents play a big role in that feeling. But most founders misunderstand what matters.

Buyers are not counting how many filings you have. They are studying how those patents protect revenue, block competitors, and fit into their own long-term plans.

Let’s break down what truly matters from a buyer’s point of view.

Buyers Look for Revenue Protection

Your patent portfolio must tie directly to how your company makes money.

If a patent does not protect a core feature, product line, or technical edge that drives sales, it will not carry much weight in an acquisition review.

Buyers ask a simple question: if we buy this company, what prevents someone else from copying the money-making parts?

This is where many startups miss the mark. They file patents on side experiments or early prototypes that never became part of the real product. During due diligence, those filings look like noise.

They do not support valuation because they do not protect revenue.

To prepare, map each patent to a current or future revenue stream. If you cannot clearly explain how a patent blocks competition around a paying product, that filing needs to be reconsidered.

Either strengthen it, narrow it to something meaningful, or consider whether it belongs in your long-term plan at all.

A smart move is to prepare a simple internal memo for each key patent explaining how it ties to sales. When buyers ask, you will not scramble. You will show clarity and confidence.

If you want help identifying which inventions are worth protecting in the first place, see how PowerPatent works with founders to align filings directly with business goals: https://powerpatent.com/how-it-works

Buyers Look for Clean Ownership

Nothing slows a deal faster than unclear ownership.

During acquisition review, lawyers will check who owns every patent and application.

If a former contractor signed no assignment, or if a co-founder left without proper paperwork, it becomes a risk. Buyers do not want risk. They want clean transfer.

Before entering any serious M&A conversation, review your chain of title. Confirm that every inventor signed proper assignment documents.

Confirm that the company, not individuals, owns the rights. Check that no old employer agreements conflict with your current filings.

If you raised venture funding, confirm that there are no hidden license terms buried in early agreements.

These details feel small while building. But during acquisition, they can reduce price or delay closing.

Founders who work with structured systems and real attorney oversight from day one avoid this chaos.

That is why combining software with expert review matters. It keeps your documentation clean as you grow, not just when a buyer shows up. You can see how that works here: https://powerpatent.com/how-it-works

Buyers Look for Defensive Strength

A patent that sounds broad is not the same as a patent that is strong.

Buyers evaluate how hard it would be for a competitor to design around your claims. If your patent can be easily bypassed with a small tweak, it will not carry much weight in negotiations.

This is where strategic drafting matters. Claims must focus on the true technical advantage, not surface details. They should cover variations that competitors are likely to attempt.

One powerful exercise is to role-play as your competitor. Ask your engineering team to brainstorm how they would try to copy your product without infringing.

Then compare those ideas against your current claims. If you see easy escape routes, that is a signal to improve your filing strategy moving forward.

Strong patents anticipate future moves. They are not narrow snapshots of today’s version.

If you are early, this is the moment to fix course. Filing rushed applications just to “have something” can weaken your position later. Filing fewer but stronger patents tied to long-term differentiation creates leverage.

Buyers Look for Alignment With Their Strategy

An acquirer is not buying in a vacuum. They have a roadmap. They have competitors. They have markets they want to enter.

When reviewing your patents, they ask: does this portfolio help us move faster? Does it block someone we are worried about? Does it strengthen our existing products?

This means you must understand who your likely buyers are. Study their product lines. Study their weaknesses. Study their public statements about where they want to grow.

Then frame your patents in that context.

For example, if a large company struggles with data efficiency and your patents cover a novel compression method that improves speed and cost, highlight that alignment clearly.

During preparation, create a short strategic overview that explains how your patents complement specific industry players. Do not wait for buyers to connect the dots. Draw the map for them.

When your IP tells a story that fits into a buyer’s future, valuation conversations change tone.

Buyers Look for Focus, Not Volume

Many founders think more filings equal more value. That is rarely true.

A scattered portfolio can signal lack of direction. It may suggest that the company experiments without discipline. Buyers prefer focus. They want to see that your filings cluster around a clear technical theme.

Review your current applications. Do they revolve around a core platform? Or are they spread across unrelated ideas?

If you see fragmentation, consider narrowing future filings around your strongest moat. Concentrated protection around one powerful technology often signals maturity and clarity.

This does not mean abandoning innovation. It means protecting innovation with intention.

Strategic pruning is part of M&A readiness. Weak, outdated, or irrelevant filings drain maintenance costs and distract from your main story. Cleaning up before due diligence shows professionalism.

Buyers Look for International Coverage That Matches Market Reach

If your customers are global but your patents exist in only one country, buyers notice.

They evaluate whether protection matches commercial footprint. If you generate revenue in Europe or Asia but lack coverage there, it creates exposure.

At the same time, over-filing in countries with no market presence can look careless.

Review your geographic footprint honestly. Where are your users? Where are your competitors? Where might copycats emerge? Align patent coverage with those regions.

This step should not be reactive. It should be strategic.

Planning early with structured tools and guidance ensures that you do not waste money on unnecessary filings while also avoiding dangerous gaps.

That balance is easier when you combine smart software with real attorney oversight, instead of guessing alone.

Buyers Look for A Clear Narrative

At the end of the day, buyers are human.

If they cannot understand your patent story quickly, they lose interest. Technical depth matters, but clarity matters more.

Prepare a simple explanation of your core inventions. Explain the problem, your solution, and why competitors cannot easily copy it. Tie that explanation to business impact.

Avoid jargon. Avoid long legal language. Speak in plain words.

You should be able to explain your IP moat in under five minutes. If you cannot, refine it until you can.

This clarity often reveals weaknesses you did not notice before. It also builds internal confidence.

When your patent portfolio tells a clean, focused story tied to revenue, strategy, and defensibility, buyers lean in instead of pulling back.

And that is the real goal of M&A readiness.

How to Prune Weak Patents Before They Hurt Your Deal

When buyers review your company, they are not only looking for strength. They are scanning for risk.

Weak patents create doubt. Outdated filings create confusion. Unclear strategy lowers confidence. If your portfolio feels messy, buyers assume your execution may be messy too.

Pruning is not about cutting randomly. It is about tightening your story so only strategic protection remains. A clean portfolio sends a signal. It shows discipline. It shows focus. It shows that you understand what truly matters.

Let’s walk through how to do this the right way.

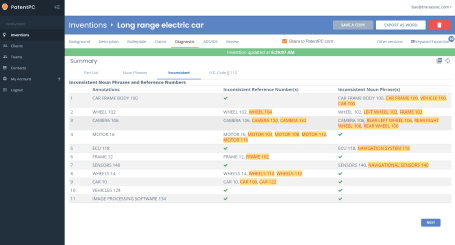

Start With a Brutally Honest Audit

Before you can prune, you need visibility.

Most founders do not regularly review their full patent portfolio. Applications were filed years ago. Some were written around features that changed. Others may protect early experiments that never shipped.

Pull every issued patent and pending application into one place. Read the claims, not just the titles. Ask yourself one hard question: does this still protect something that drives our future value?

If the answer is unclear, dig deeper.

Meet with your product and engineering leads. Show them the claims. Ask if those claims still map to what you are building today. If your team looks confused, that is a signal.

This review should not be emotional. Just because a filing took effort and money does not mean it deserves to stay central to your strategy.

Clarity here gives you control before a buyer asks tough questions.

Separate Core Protection From Legacy Filings

Every portfolio has layers. Some patents protect your main engine. Others are leftovers from early pivots.

You must clearly separate these.

Core protection surrounds your main platform, your strongest technical edge, and the features customers pay for. These filings deserve attention, maintenance, and possibly expansion.

Legacy filings often protect ideas that were never fully built or were replaced by better versions. These are the ones that create noise.

Noise makes it harder for buyers to see value. During due diligence, lawyers must review everything. If half the portfolio is unrelated to current revenue, the review becomes longer and more expensive. That can slow the deal or reduce price.

Pruning does not always mean abandoning filings immediately. Sometimes it means reframing them as secondary instead of central. It means focusing investor and buyer conversations only on what truly matters.

If you are early enough, you can even decide not to continue prosecution on applications that no longer align with your direction. That choice saves money and tightens your strategic story.

Identify Patents That Are Too Narrow to Matter

Some patents technically protect your product but in a very narrow way. They may cover one small implementation detail that is easy to change.

Buyers recognize this quickly.

If a competitor can adjust a parameter, tweak a step, or shift a component and avoid infringement, the patent does not create real leverage. It becomes symbolic rather than powerful.

Review your claims with this mindset. Ask your engineers to think like competitors again. If the design-around path feels simple, the patent may not support strong valuation.

In some cases, you may be able to file continuation applications that broaden protection strategically. In other cases, it may be better to shift focus toward new filings that better capture your true technical advantage.

This is where structured drafting and attorney review matter deeply. Weak claims often result from rushing early filings without long-term thinking.

If you want to avoid that mistake going forward, see how PowerPatent helps founders draft stronger, future-proof applications from the start: https://powerpatent.com/how-it-works

Remove Gaps That Undermine Strong Patents

Pruning is not only about cutting weak filings. It is also about strengthening what remains.

Sometimes a portfolio looks noisy because it is incomplete. You may have one strong patent on your core algorithm but nothing covering surrounding systems, integrations, or optimizations.

That imbalance can make even strong filings look fragile.

After removing irrelevant patents from your main narrative, review whether your core protection stands alone or is supported by related filings. Buyers like layered protection. It signals that you thought ahead.

If you identify gaps, you can still act. Filing targeted applications before entering serious M&A talks can strengthen your position. The key is to ensure these filings are strategic, not reactive.

Reactive filings often feel rushed and may not add real depth. Strategic filings map directly to future product evolution and competitive risk.

Clean Up Documentation Before Buyers Ask

One of the most common deal slowdowns happens when buyers request documentation that founders cannot easily produce.

Maintenance fee records, assignment agreements, filing receipts, office action responses. These documents matter during due diligence.

Pruning your portfolio includes organizing these materials. Create a clean digital folder for each patent family. Ensure ownership records are updated. Confirm that deadlines were met and payments are current.

When buyers request information, fast and complete responses build trust. Delays create doubt.

Trust influences valuation more than most founders realize.

Platforms that combine smart tracking with real attorney oversight make this much easier over time. Instead of scrambling at the end, your records stay clean as you grow.

You can explore how that works here: https://powerpatent.com/how-it-works

Align Maintenance Spending With Strategic Value

Patents cost money to maintain. As your portfolio grows, fees increase.

Pruning includes making conscious decisions about where to invest.

If a patent does not protect current or future revenue, question whether continuing to pay maintenance makes sense. That capital could be redirected toward stronger filings that support your exit goals.

This does not mean cutting aggressively without thought. It means reviewing each asset as an investment decision.

Buyers respect disciplined capital allocation. A focused portfolio shows that you manage resources wisely.

Prepare a Clear Before-and-After Story

After pruning, your portfolio should feel sharper. But buyers will not automatically see that transformation unless you present it clearly.

Prepare a simple narrative that explains how your patent strategy evolved. Share how early experimentation led to refined focus. Explain how current filings align tightly with product and market direction.

This transparency shows maturity. It shows that your company grows strategically, not randomly.

In many cases, pruning actually increases buyer confidence because it demonstrates intentional leadership.

A disciplined patent portfolio is a signal. It tells acquirers that your company thinks long term, manages risk carefully, and protects what truly matters.

That is the kind of signal that supports stronger negotiations and smoother closings.

Turning Core Technology Into Strategic, High-Value Claims

Most startups sit on powerful ideas but protect them the wrong way. They describe features instead of advantages.

They file around what the product looks like today instead of what it will become tomorrow. When that happens, patents exist on paper but do not create real leverage in an acquisition.

Strategic claims change that. They turn your core technology into control. They make it hard for competitors to copy you. They give buyers confidence that your edge will last after the deal closes.

This section is about doing that work intentionally.

Start With the Technical Advantage, Not the Feature

Every strong patent begins with a simple question: what makes this truly different?

Founders often answer with a product feature. But features change. Interfaces change. Code gets rewritten. Buyers know this.

Instead, focus on the technical advantage underneath.

Maybe your system processes data with lower latency because of a unique model architecture. Maybe your hardware design reduces heat using a new structure.

Maybe your platform predicts outcomes with less training data because of a new training method.

That deeper advantage is what must be protected.

When drafting claims, the goal is to capture the engine, not the paint. If you only protect surface details, competitors can repaint and move on.

Work with your engineers to identify the real breakthrough. Ask them what would be hardest for a competitor to replicate. That answer usually points to the claim foundation.

If you want a system that helps extract that insight from your code and models without slowing down development, see how PowerPatent approaches invention capture: https://powerpatent.com/how-it-works

Expand Protection Around Variations

Once you identify the core advantage, think about how it might evolve.

Your product today is version one. In two years, it will look different. The underlying advantage may remain, but implementation details will shift.

High-value claims anticipate this change.

For example, if your invention improves model training efficiency, do not limit protection to one specific data type or environment.

Think about different use cases, deployment modes, or system architectures where the same core method applies.

This is not about being vague. It is about being thoughtful.

Map out likely product upgrades. Discuss roadmap plans internally. Then ensure your claims cover those directions before they ship.

When buyers see patents that align with future roadmap, they view them as forward-looking assets rather than outdated filings.

Tie Claims Directly to Competitive Pressure

Strong patents create pressure.

To build that pressure, study your competitors closely. What approaches are they using? Where are they struggling? What shortcuts might they take to catch up to you?

Now compare those patterns with your claim language.

If a competitor is likely to adopt a similar system structure, your claims should address that structure in a way that blocks easy entry. If competitors rely on a common workaround, your filing should anticipate and cover that variation.

This requires technical depth and strategic awareness. It is not just legal drafting. It is competitive positioning written into claim language.

Before filing, hold an internal “design around” session. Ask your team to imagine how a rival would avoid infringement. Adjust your claim strategy based on those answers.

This small step can dramatically increase long-term value.

Focus on Business Impact Inside the Claims

Buyers care about revenue impact. Your claims should reflect that.

If your invention reduces costs, improves speed, increases accuracy, or enhances scalability, those functional outcomes should be clear within the structure of the claims.

This makes it easier during M&A discussions to connect legal protection with business results.

For example, if your system reduces server costs by processing data differently, ensure that the claims clearly describe the mechanism that enables that cost reduction.

During due diligence, buyers often bring technical experts to review patents. When those experts see clear alignment between claimed methods and measurable impact, confidence rises.

This connection strengthens valuation conversations.

Build a Layered Protection Strategy

One strong patent is good. A thoughtful group of related filings is better.

Layered protection means covering different parts of your system that work together.

If you have a core algorithm, consider protecting the training method, the deployment method, and the system architecture that supports it. Each filing should reinforce the others.

This does not mean filing randomly. It means mapping your technical stack and identifying the most defensible layers.

When buyers see multiple patents protecting connected parts of a platform, they perceive depth. Depth signals durability.

Durability influences price.

Avoid Filing for Optics

Some founders rush filings because they want to say they “have patents.”

Buyers can tell when filings exist only for show. Thin claims, rushed drafting, and unclear scope stand out during review.

High-value claims require time and strategic thought. They require understanding both technology and business goals.

If you are preparing for acquisition in the next few years, it is better to invest in fewer, stronger filings than to scatter resources across weak applications.

Strong filings require structure. They require extracting invention details directly from your technical team without translation errors. They require real attorney oversight to ensure claims are defensible.

That combination of smart software and human review is what prevents costly mistakes later. If you want to see how that process works in practice, explore it here: https://powerpatent.com/how-it-works

Document the Story Behind Each Strategic Patent

Turning technology into strong claims is only part of the equation.

You should also prepare a simple internal explanation of why each key patent matters. Describe the problem it solves, how it improves the system, and what risk it blocks.

When M&A talks begin, you will not have time to reverse-engineer this narrative. Having it ready positions you as prepared and intentional.

It also helps your team stay aligned on what truly differentiates your company.

A patent portfolio should not feel like a pile of legal documents. It should feel like a clear map of your competitive edge.

When core technology is translated into thoughtful, future-proof claims, your IP becomes more than protection. It becomes leverage.

And leverage is what drives strong acquisition outcomes.

Presenting Your IP Story So Acquirers See Immediate Leverage

You can have strong patents and still lose leverage if you present them poorly.

During M&A, perception shapes price. Buyers move fast. They scan for risk. They look for clarity.

If your patent portfolio feels complex or hard to understand, they mentally discount it. Not because it lacks value, but because they cannot quickly see it.

Your job is to make your IP story simple, sharp, and impossible to ignore.

This is where many founders fall short. They assume the documents speak for themselves. They do not. You must frame the narrative.

Lead With the Business Outcome, Not the Legal Language

When presenting your portfolio, do not start with claim numbers or filing dates. Start with impact.

Explain in plain words what your protected technology enables. Does it cut costs in half? Does it double processing speed? Does it allow customers to do something no competitor can offer?

Buyers care about outcomes first. Once they see clear business value, they will dig into legal strength.

Prepare a short executive summary of your patent strategy written for non-lawyers. Keep it tight. Keep it focused on advantage.

When acquirers understand in the first few minutes why your IP matters to revenue, market share, or strategic expansion, the tone of the conversation shifts.

Connect Each Core Patent to a Strategic Threat

Every acquirer has fears. A strong IP presentation speaks directly to those fears.

If the buyer worries about a specific competitor, show how your patents block that competitor’s likely path. If they want to expand into a new vertical, explain how your protected technology gives them a head start.

This requires preparation. Study your likely acquirers in advance. Understand their gaps. Then map your patents to those gaps.

During meetings, do not say, “We have ten patents.” Say, “This patent prevents competitors from replicating our low-latency processing method, which is critical for real-time analytics in your target market.”

That level of alignment creates leverage.

Show Depth Without Overwhelming

Buyers will conduct deep technical review later. In early conversations, your goal is clarity, not complexity.

Present a focused set of strategic filings first. These should represent your core moat. Explain them clearly and confidently.

Avoid walking through every application in detail. That creates noise.

Instead, communicate that your portfolio is layered and organized. Offer additional detail when requested.

This approach shows discipline. It also signals that you understand which assets truly matter.

When your presentation feels curated rather than chaotic, buyers assume the underlying business is equally disciplined.

Demonstrate Clean Process and Oversight

A well-presented portfolio also reflects how it was built.

Buyers gain confidence when they see that your patent process was structured, not improvised.

If you can explain that your filings were created with real attorney oversight and strategic alignment to product development, it reduces perceived risk.

Risk reduction directly affects valuation.

If your documentation is organized, assignments are clean, deadlines are met, and claims are consistent with your current product, due diligence moves smoothly.

Smooth diligence keeps momentum high. Momentum supports strong deal terms.

This is why combining software efficiency with real attorney review from the start matters. It prevents small mistakes that can grow into negotiation friction later.

If you want to understand how that kind of structured approach works, you can explore it here: https://powerpatent.com/how-it-works

Translate Technical Strength Into Negotiation Power

Your patents are not just legal shields. They are negotiation tools.

When buyers believe that your technology is well protected, they know competitors cannot easily copy it if the deal falls through. That knowledge shifts power toward you.

In subtle ways, strong IP influences how aggressive buyers are with price adjustments. It affects how much they push on reps and warranties. It shapes how quickly they want to close.

To strengthen this effect, prepare data that shows adoption, technical performance, or market validation tied to your patented methods. When legal protection and market proof reinforce each other, leverage multiplies.

This does not require exaggeration. It requires clear linkage.

Explain how your patents support defensibility in real-world conditions. Buyers respond to tangible advantage, not abstract filings.

Anticipate Hard Questions Before They Are Asked

Smart acquirers will probe weaknesses.

They may ask why certain applications are still pending. They may question geographic coverage. They may challenge the breadth of specific claims.

Prepare answers in advance.

If a claim is narrow, explain the strategy behind it. If an application is pending, outline expected timelines and scope. If you chose not to file in certain regions, show that decision was intentional and aligned with market focus.

Prepared responses show control. Uncertain responses create doubt.

Control influences trust. Trust influences price.

Frame Your Portfolio as a Growth Engine

The strongest IP stories do not focus only on protection. They highlight expansion.

Show how your patents support future product lines. Explain how they open doors to licensing opportunities or new markets.

When buyers see that your portfolio does more than defend current revenue, they begin to see upside. Upside drives premium valuations.

This forward-looking framing is powerful. It shifts the conversation from risk mitigation to growth acceleration.

Keep the Story Consistent Across All Materials

Your pitch deck, data room, technical documentation, and executive conversations should all reflect the same IP narrative.

Inconsistency creates confusion.

If your deck highlights one patent as core but your engineering team describes another as critical, buyers notice. Alignment signals maturity.

Before entering serious discussions, rehearse your IP story internally. Ensure leadership, engineering, and legal advisors speak from the same strategic playbook.

Consistency builds credibility.

Make IP Readiness a Continuous Practice

Do not treat M&A readiness as a last-minute sprint.

The best outcomes happen when IP strategy is built alongside product development from day one. When patents are aligned with roadmap, revenue, and long-term vision, presenting them becomes easy.

Waiting until an acquisition offer appears often leads to rushed filings, messy documentation, and reactive positioning.

Building early with intention creates calm later.

That is why structured systems matter. Smart software helps you capture innovation quickly. Real attorney oversight ensures quality and defensibility. Together, they reduce noise and amplify strategic value.

If you are serious about making your IP a deal-making asset instead of a liability, take time to understand how a modern approach can support you: https://powerpatent.com/how-it-works

When your portfolio is clean, strategic, and clearly presented, buyers do not hesitate. They see leverage. They see protection. They see growth.

And when they see those things clearly, your company becomes far more than a product. It becomes a protected advantage worth paying for.

Wrapping It Up

M&A readiness is not about scrambling when a buyer shows up. It is about building leverage long before that moment arrives. When you prune weak filings, sharpen your strongest claims, and present a clear story, your patent portfolio becomes an asset that drives confidence. Buyers move faster. Diligence feels smoother. Negotiations feel more balanced.